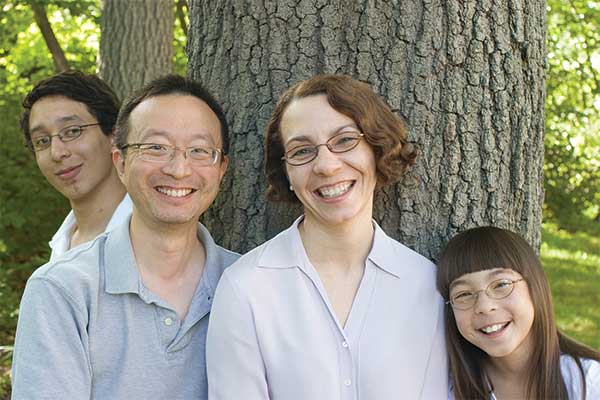

Michele Minter and her husband, Jeff Yuan, were already familiar with philanthropy when they established the Minter-Yuan Family Fund. Jeff is active in charitable efforts to eliminate river blindness in Africa. Michele’s father was president of the Cleveland Foundation for twenty-five years.

“In my work life, I’m a nonprofit fundraiser,” Michele says. “I’ve spent a lot of time talking to people about their philanthropy, the importance of trying to organize it, and the idea that, within your means, whatever they are, you should think like a philanthropist and be strategic about it. Some insights I had while I was a trustee of the Community Foundation got Jeff and me thinking about how to be a little more systematic about our giving. Setting up a fund at the Community Foundation became an incredibly helpful way to do that.”

Jeff, who does pharmaceutical research at Merck, agrees: “Both of us feel strongly about social-action causes locally, nationally, and internationally. The Community Foundation gave us a vehicle for directing our philanthropy more systematically. For example, we can make international grants, and the Community Foundation does the due diligence for us.”

“One of the things that was a great help to us,” Michele says, “is that Jeff has a very generous one-to-one match from his employer for charitable gifts. Our donor-advised fund gives us a lot of flexibility. So rather than donating, say, $1,000 to each of three charities and having Merck match each gift, we can give $3,000 to our donor-advised fund at the Community Foundation. With the Merck match, we’d then have $6,000 in our fund to allocate however we want it among those three charities, or even somewhere else. We add to our fund when it’s convenient, and advise our grants when we’re ready to make decisions. So we can change our strategy after we’ve made the gift.”

Jeff appreciates the convenience. “We receive reports that make everything easier to track,” he says. “That’s a huge plus, both for making donations and making grant decisions. I think of our fund as a flexible philanthropic savings account. Every year, we decide on a target that we want to save towards, to give away.”

“Then we write only one check,” Michele says. “And we can transfer stock, which is not that easy to do if you plan to make grants to multiple charities. At tax-year-end you’re not worried about trying to track down receipts from various organizations. You have a consolidated receipt from the Community Foundation, with detailed reports not only of the market value of the fund and what its investment earnings have been, but what we gave. We can follow the patterns in our priorities, and how they’re shifting. If we stop and really think, ‘What is the biggest number that we can stretch to this year?’ rather than doing it piecemeal, I think we end up with a larger outcome. We’re more focused and we make more ambitious decisions”

What about their children, Mira, age 10, and Brian, 14?

“My parents are very philanthropic relative to their means,” Michele says. “So I had great role models. We have asked our kids to help choose some charities that they want to give to. Mira chose Heifer International. Brian supports Kiva, a micro-lending bank. They know there are people in other countries who need things and whose lives are very different. But mostly we’ve tried to model philanthropy by getting them involved in things right here, like going on a Crisis Ministry Walk and the Isles Garden Tour.

“Learning to view yourself as a philanthropist, with whatever money you have, and trying to do some good in an impactful way, is something we really want to teach our children,” Michele says. “For that, I think our fund is a perfect vehicle.”