Do you want to give back to the causes you care about most? Read our guide below, to learn more about the tax benefits of charitable funds.

Opening a charitable fund at the Princeton Area Community Foundation can help you make the most of your charitable giving under current tax laws.

When you make a gift to your donor advised fund, you’ll receive an immediate tax benefit.

You can open a fund cash, stock or other assets, such as life insurance policies or real estate.

Tax Benefits of Charitable Funds

Here are some of the tax benefits that come with charitable funds:

Stock donations

Donate appreciated stock: capital gains tax is avoided when you transfer long-term, marketable securities to a fund at the Community Foundation, making this a tax-savvy way to give to charity.

QCDs

Qualified charitable distributions: Another tax-efficient way to give is through a rollover of an IRA distribution. If you are age 70 ½ or older, you can make a qualified charitable distribution from your IRA to certain types of funds, including designated funds.

Bunch Your Donations

Bunching gifts: If your total deductions are at or under the standard deduction amount, but you and your financial advisors determine you could benefit from increased deductions, you might consider bunching your donations using a charitable fund. You can structure a large year-end gift to your donor-advised fund, so you can surpass the standard deduction threshold to further reduce your taxes. Then, you can recommend grants from your fund to your favorite nonprofits this year and in subsequent years.

Charitable remainder trust

Charitable remainder trust: this giving vehicle can help you retain an income stream, while getting the benefit of an up-front charitable deduction.

Tax Deductions

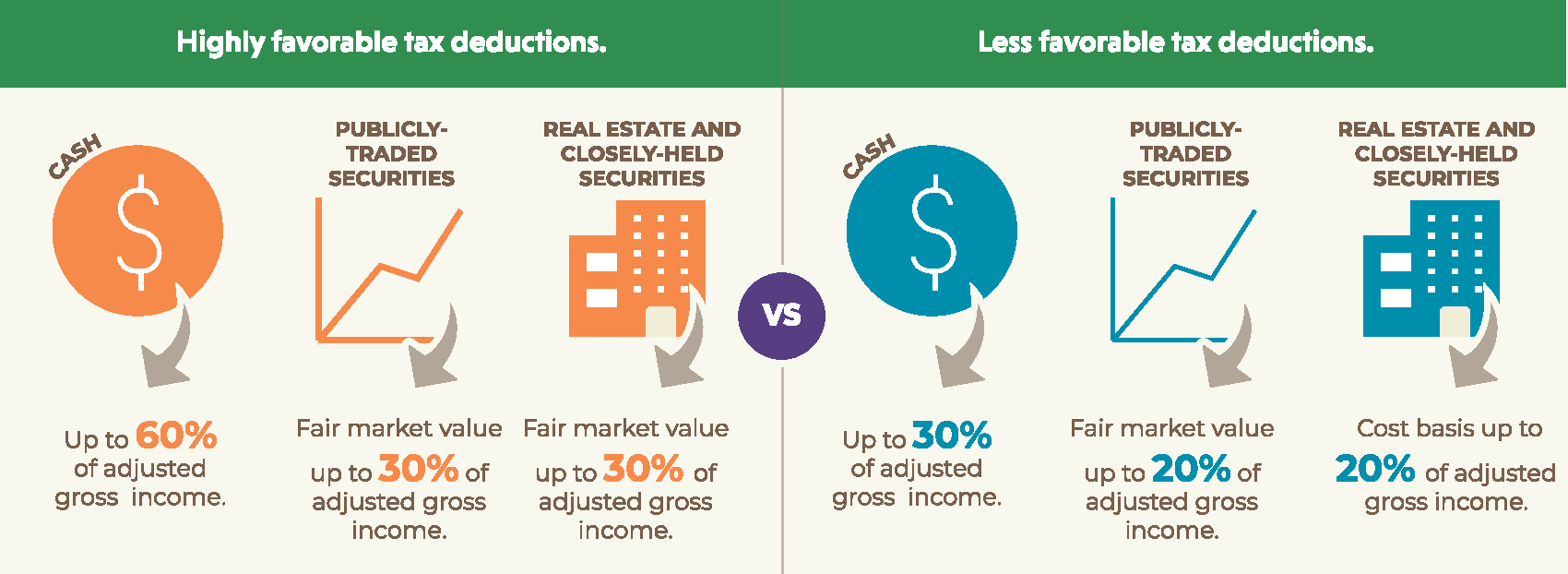

Highly favored tax deductions: As you can see in the chart below, Donor Advised Funds (on the left) come with highly favored tax deductions, compared to private foundations (shown on the right):

Contact us to learn more about making the most of your charitable giving:

For more information, contact Steven Spinner, at sspinner@pacf.org or Gabrielle Markand, at gmarkand@pacf.org.

For more information or support, please contact:

Steven Spinner

Chief Philanthropy Officer

Email Steven Spinner

Gabrielle Markand

Senior Director of Philanthropy

Email Gabrielle Markand