Steps for Starting a Private Foundation

Do you want to learn more about how to start a private foundation? Here are some of the steps you’ll need to take:

- Before starting a private foundation, consult with legal and wealth advisors.

- Research state laws to determine the rules for establishing a private foundation.

- Once you have met all state legal requirements to form a foundation, including drafting bylaws and articles of incorporation, you can seek tax-exempt status from the IRS.

- Think about how you plan to manage your private or family foundation:

- You will need to recruit volunteers to serve as Trustees

- You may want to consider hiring staff

- You should retain legal counsel and accounting services

Why a Donor Advised Fund might be a better option than starting a private foundation

If you start a private foundation, it can be a costly and time-consuming process. A donor advised fund at the Community Foundation can be a much easier and more efficient way to achieve your charitable goals.

Opening a fund with us is simple: fill out a two-page form and make a tax-deductible contribution to the fund. Gifts to your fund always quality for the maximum tax benefits under state and federal law. You’ll recommend grants from your fund, and our staff will handle all the paperwork.

A charitable fund at the Community Foundation allows you to focus on giving to the causes you care about most.

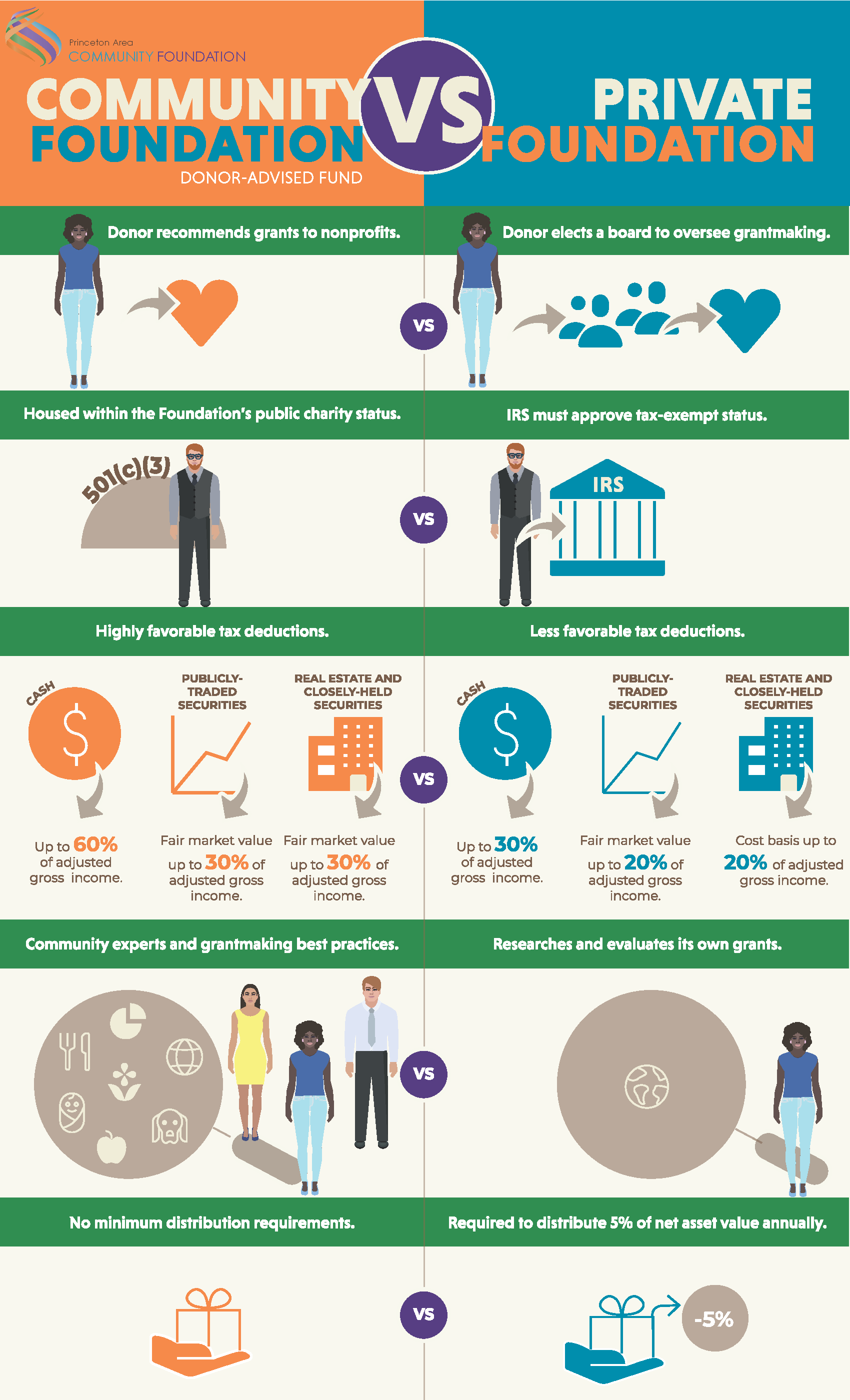

More differences between private foundations and donor advised funds

There are other significant differences between private foundations and a donor advised fund at the Community Foundation.

A donor advised fund can provide more favorable tax deductions than a private foundation.

There is no minimum distribution requirement for donor advised funds, but private foundations must distribute 5% of their net asset value annually.

For more information or support, please contact:

Marcia Shackelford

Chief Philanthropy Officer

Email Marcia Shackelford

Michael Nuno

Vice President, Philanthropic Services

Email Michael Nuno

Watch the video below to learn more about how a donor advised fund works.

To learn more about opening a donor advised fund at the Community Foundation, contact us:

Marcia Shackelford, Chief Philanthropy Officer

609.219.1800 Ext. 809 or email Marcia

Michael Nuno, Vice President, Philanthropic Services

609.219.1800 Ext. 808 or email Michael